With over 1.38 billion monthly active users, WeChat has solidified its position as China’s leading digital ecosystem. The WeChat Luxury Index 2024 provides a comprehensive analysis of how luxury brands leverage WeChat’s diverse functionalities to enhance brand visibility, engage with consumers, and drive sales. This report highlights key trends, challenges, and best practices for premium brands looking to strengthen their digital presence in China.

The Evolution of WeChat in Luxury Marketing

Over the years, WeChat has transformed from a simple messaging app into a powerful marketing and commerce hub. Today, luxury brands use WeChat’s multi-faceted tools, including:

- Official Accounts (OA): Primary content distribution channels.

- Mini Programs: Integrated e-commerce platforms within WeChat.

- WeCom: A business communication tool for personalized client engagement.

- WeChat Channels: Video and livestreaming features to boost engagement.

- Search and Brand Zone: Paid advertising solutions to capture high-intent consumers.

Key Findings from the WeChat Luxury Index 2024

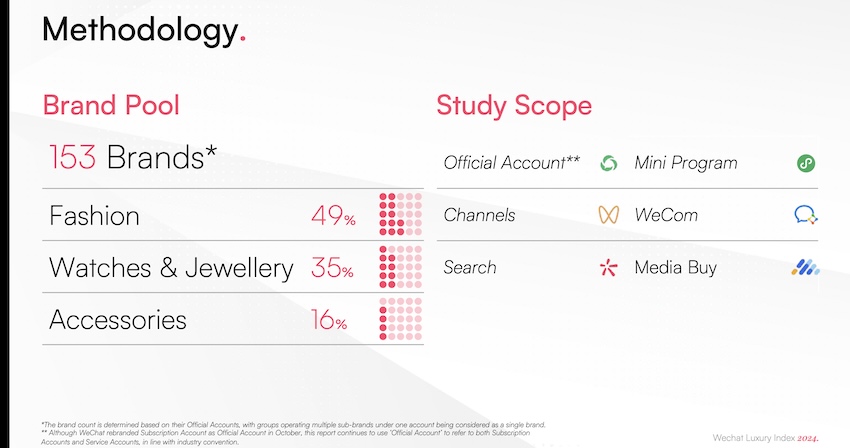

The WeChat Luxury Index 2024 evaluates 153 luxury brands across seven key dimensions, revealing how they utilize WeChat to engage Chinese consumers. Below are the main takeaways:

Screenshot

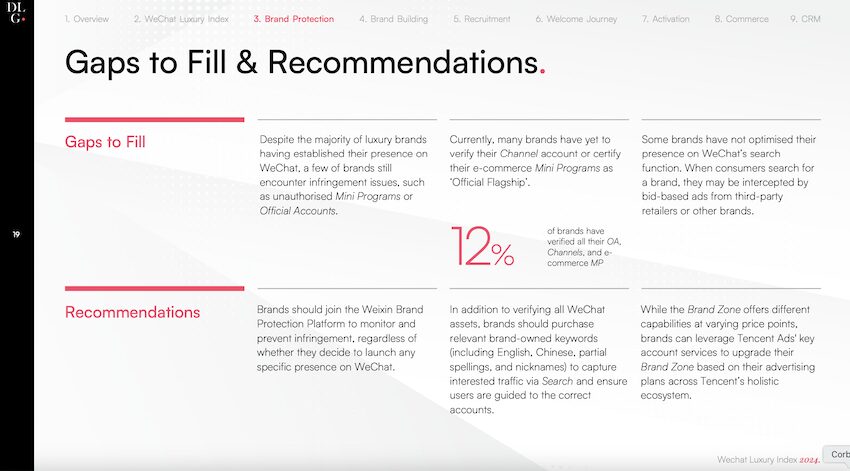

1. Brand Protection: Safeguarding Brand Integrity

- 33% of luxury brands have adopted the WeChat Brand Zone to prevent counterfeiting and unauthorized resellers.

- Tencent’s Weixin Brand Protection Platform blocked over 1,380 fake Mini Programs in 2024.

- Brands should prioritize verification of their Official Accounts, Channels, and Mini Programs to protect their digital assets.

2. Brand Building: Strengthening Digital Presence

- 80% of brands incorporate evergreen brand stories into Mini Programs.

- 29% of luxury brands now use WeChat’s « Little Green Book » content format, mirroring Xiaohongshu (RED) for better engagement.

- Saint Laurent successfully used WeChat Channels ads to promote their Spring 2025 runway show, leading to 3M+ livestream viewers.

3. Recruitment: Gaining New Followers and Customers

- Brands using WeChat media buy campaigns (ads on Moments, Channels, Mini Programs) saw a 70% lower cost per follower (CPF) compared to industry benchmarks.

- Richard Mille’s targeted Moments Ads reduced CPF while growing both Official Account and Channels followers.

- 53% of brands fail to provide any incentives on their Mini Programs, missing a key opportunity for audience conversion.

4. Welcome Journey: Optimizing Customer Onboarding

- 71% of brands link their Official Website to their WeChat Official Account, driving seamless onboarding.

- Mini Program-based notifications have become a primary tool for sending order updates, event invites, and exclusive offers.

- Tiffany & Co. leads in personalized onboarding, integrating CRM with WeChat to send tailored messages to new followers.

5. Activation: Enhancing Consumer Engagement

- 92% of brands’ brand ambassadors (BAs) actively use WeCom Moments, increasing one-to-one engagement.

- WeChat’s Service Account feed update led to a decline in open rates, forcing brands to shift to alternative engagement strategies.

- Hermès’ interactive Mini Program game during their Shanghai event generated high engagement, showcasing creative use of WeChat’s ecosystem.

6. Commerce: Leveraging WeChat for Direct Sales

- 77% of luxury brands have an e-commerce Mini Program within WeChat, making it the leading direct-to-consumer (DTC) channel in China.

- Cartier’s Global Buy Mini Program supports Chinese travelers by providing location-based store information and currency conversion tools.

- Harry Winston’s Mini Program focuses on high-net-worth individuals (HNWIs) by offering in-store consultation bookings instead of direct sales.

7. CRM: Strengthening Customer Loyalty

- WeCom is underutilized, with 53% of brands not enabling customer interactions via WeChat.

- Only 46% of brands require consent for Mini Program notifications, leading to missed opportunities for re-engagement.

- Acne Studios’ personalized gifting services via Mini Program set a benchmark for customer retention strategies.

Key Takeaways for Luxury Brands

The WeChat Luxury Index 2024 underscores the importance of adapting to evolving consumer behaviors and leveraging WeChat’s full potential. Here are actionable steps for brands:

- Prioritize omnichannel brand protection – Verify all WeChat assets and actively monitor counterfeit activities.

- Invest in creative content formats – Use WeChat Channels and « Little Green Book » for high engagement.

- Enhance CRM strategies – Leverage WeCom and Mini Program messaging for personalized customer journeys.

- Optimize e-commerce experiences – Differentiate WeChat e-commerce from other platforms like Tmall or JD.com with exclusive services.

- Leverage data-driven marketing – Use WeChat’s Brand Zone and media buying tools for targeted audience reach.

Conclusion

As the Chinese digital landscape continues to evolve, WeChat remains an indispensable tool for luxury brands. The insights from the WeChat Luxury Index 2024 provide a roadmap for brands aiming to optimize their consumer engagement, sales, and brand loyalty within WeChat’s powerful ecosystem. By adopting best practices and staying agile in digital strategies, luxury brands can continue to thrive in China’s competitive market.

***

Source : The WeChat Luxury index was launched by the DLG group, a pioneering series of reports designed to address a gap in luxury brand marketing. By focusing on recruitment, retention, and optimisation, the Index provided brands with actionable metrics to objectively evaluate their performance within the WeChat ecosystem.

DLG (Digital Luxury Group) is an independent marketing and technology group with offices in Geneva, Shanghai, and New York. The company provides social media, e-commerce, CRM, consulting, and creative services to luxury and lifestyle brands. DLG is renowned for its expertise in defining and implementing impactful business strategies, combining technological know-how, creativity, and luxury savoir-faire to target sophisticated consumers.

DLG also publishes Luxury Society, a trusted intelligence platform for luxury executives, offering a global perspective on the industry through exclusive studies, reports, analysis, features, and in-depth interviews with industry leaders.

For more information, visit www.digitalluxurygroup.com